Driving Digital Transformation with e Pay Solutions

In the fast-paced, technology-driven world of today, businesses face increasing pressure to adapt, innovate, and thrive in the digital landscape. Digital transformation is no longer optional; it is essential for organizations seeking to remain competitive and relevant in an era where customer expectations, operational efficiency, and market dynamics are shaped by digital technologies. e Pay is at the forefront of enabling businesses across industries to embrace this transformation through comprehensive, scalable, and secure digital solutions that streamline operations, enhance customer experiences, and drive long-term growth.

This article explores how e Pay empowers organizations with cutting-edge digital transformation solutions, including financial technology (FinTech), cloud-based platforms, cybersecurity, and advanced data analytics. By leveraging e Pay’s tools and expertise, businesses can unlock the full potential of digital innovation.

Digital Payments and Remittances

With e Pay’s digital payment infrastructure, businesses can offer seamless payment experiences across multiple channels, whether it’s online, mobile, or in-store. The platform supports instant payments, real-time settlements, and cross-border transfers, enhancing operational efficiency and customer satisfaction.

CBDC Solutions

e Pay also provides comprehensive solutions for governments and central banks seeking to issue and manage digital currencies. CBDCs represent the future of sovereign money, and e Pay’s secure, scalable platform supports their development and implementation.

Blockchain and Distributed Ledger Technology (DLT)

e Pay leverages the power of blockchain to offer secure, transparent, and decentralized solutions for businesses. From ensuring data integrity to automating transactions through smart contracts, blockchain enables unprecedented trust and transparency in digital ecosystems.

Our Vision as a Digital Transformer

By integrating FinTech solutions, we firmly belive that businesses can enhance their financial operations, improve customer trust, and future-proof their services for the digital economy.

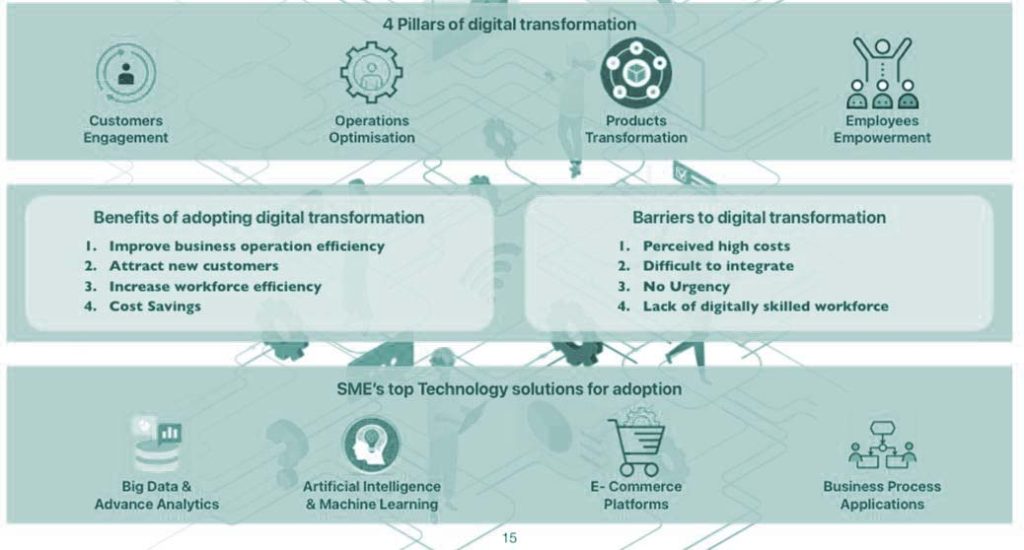

The Pillars of Digital Transformation

Digital transformation involves more than just adopting new technologies; it’s about rethinking and reshaping business processes, customer interactions, and operational models to leverage the power of digital tools. e Pay addresses several core areas essential to digital transformation:

- Financial Technology (FinTech) Solutions

- Cloud & Digital Storage

- Cybersecurity

- Data Analytics & Artificial Intelligence

- Open Banking & APIs

1. Financial Technology (FinTech) Solutions

FinTech is driving the future of finance, enabling businesses to offer faster, more secure, and more personalized financial services to customers. e Pay provides a suite of FinTech solutions that support everything from digital payments and remittances to blockchain platforms and Central Bank Digital Currency (CBDC) development. By incorporating e Pay’s FinTech solutions, businesses can revolutionize their financial processes in ways that were previously unimaginable.

Digital Payments and Remittances: With e Pay’s digital payment infrastructure, businesses can offer seamless payment experiences across multiple channels, whether it’s online, mobile, or in-store. The platform supports instant payments, real-time settlements, and cross-border transfers, enhancing operational efficiency and customer satisfaction.

Blockchain and Distributed Ledger Technology (DLT): e Pay leverages the power of blockchain to offer secure, transparent, and decentralized solutions for businesses. From ensuring data integrity to automating transactions through smart contracts, blockchain enables unprecedented trust and transparency in digital ecosystems.

CBDC Solutions: e Pay also provides comprehensive solutions for governments and central banks seeking to issue and manage digital currencies. CBDCs represent the future of sovereign money, and e Pay’s secure, scalable platform supports their development and implementation.

By integrating FinTech solutions, businesses can enhance their financial operations, improve customer trust, and future-proof their services for the digital economy.

2. Cloud & Digital Storage Solutions

In the era of big data and remote operations, cloud computing is a foundational element of digital transformation. e Pay’s cloud and digital storage solutions enable organizations to access and manage their data securely from anywhere, at any time. With scalable infrastructure and flexible storage options, e Pay ensures that businesses have the agility to grow and respond to market changes while reducing operational costs.

Scalability and Flexibility: e Pay’s cloud solutions are designed to scale with your business, ensuring you only pay for the resources you need. As your data storage and processing needs grow, e Pay provides seamless scalability without compromising performance.

Data Security: Security is a top priority for e Pay’s cloud solutions. Through encrypted data storage, secure backups, and strict access controls, e Pay ensures that your critical business data remains protected from cyber threats.

By moving to the cloud, businesses can optimize their IT operations, improve collaboration, and drive innovation while staying secure and compliant.

3. Cybersecurity: Protecting the Digital Frontier

Digital transformation brings countless opportunities, but it also opens businesses up to new vulnerabilities and threats. Cybersecurity is a critical component of any digital transformation strategy, and e Pay offers robust security solutions to safeguard businesses from evolving cyber risks.

Advanced Threat Detection: e Pay’s cybersecurity platform employs AI and machine learning to detect and respond to cyber threats in real-time. Whether it’s phishing attacks, ransomware, or unauthorized access, e Pay’s proactive security measures help prevent breaches before they cause harm.

Identity and Access Management (IAM): Managing who has access to your systems is vital in a digital world. e Pay’s IAM solution ensures that only authorized users can access sensitive data and systems, reducing the risk of insider threats and data breaches.

By integrating advanced cybersecurity solutions, businesses can confidently adopt digital tools without fear of compromising their security or reputation.

4. Data Analytics & Artificial Intelligence (AI)

Data is the lifeblood of digital transformation, providing insights that can fuel innovation, drive strategic decisions, and deliver personalized customer experiences. e Pay’s data analytics and AI solutions help businesses turn raw data into actionable intelligence.

Real-Time Analytics: e Pay enables businesses to harness the power of real-time data, providing instant insights into customer behavior, market trends, and operational performance. This allows organizations to make informed decisions quickly and stay ahead of the competition.

AI-Driven Automation: Artificial intelligence can transform how businesses operate by automating routine tasks, identifying patterns, and even predicting future trends. e Pay’s AI-driven solutions help businesses enhance productivity and reduce operational costs by streamlining processes and workflows.

With powerful data analytics and AI tools, businesses can gain a deeper understanding of their operations and customers, enabling them to optimize performance and deliver superior experiences.

5. Open Banking & API Integration

Open Banking is reshaping the financial services landscape by allowing third-party developers to access financial data and services through secure APIs. e Pay supports Open Banking initiatives, providing businesses with the tools they need to integrate with third-party applications and offer innovative financial products.

Seamless Integration: e Pay’s platform supports easy API integration, enabling businesses to collaborate with third-party developers and expand their offerings. From new payment methods to enhanced financial services, Open Banking unlocks new opportunities for growth.

Regulatory Compliance: e Pay ensures that all Open Banking integrations are compliant with regulations like PSD2, ensuring that businesses can take advantage of this trend without risking penalties or breaches.

By adopting Open Banking, businesses can stay competitive, innovate faster, and deliver more personalized services to their customers.